Ruto Wants This From Teachers’ Payslips

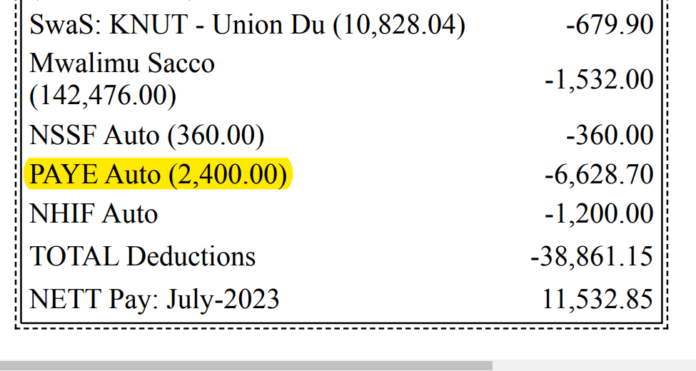

Teachers and other salaried employees may see their incomes reduced if the Treasury’s proposal to eliminate tax breaks on pay-as-you-earn (PAYE) taxes is implemented. These individuals currently receive a personal tax relief of Sh2,400, which is normally noted on their monthly payslips.

However, the Treasury intends to evaluate these tax breaks on employment earnings in its recently revealed medium-term revenue strategy in order to increase tax revenues.

While tax incentives can affect taxpayer behavior, they also result in lost tax income, complicate the tax system, and impair its equity-promoting effectiveness, according to the Treasury. According to research, these incentives may not have a major impact on taxpayer behavior.

Salary workers currently benefit from two types of PAYE tax breaks. The first is a Sh2,400 monthly personal relief for all resident individuals, with the goal of lowering the tax burden. Those who pay insurance premiums for life, health, or education plans for themselves, spouses, or children can also claim a 15% tax break, up to Sh60,000 per year, if the policies have a maturity period of at least 10 years. In January of the previous year, contributions to the National Hospital Insurance Fund (NHIF) became eligible for insurance relief as well.

The Treasury’s proposal to withdraw these tax breaks has alarmed tax experts, who are concerned that it will further reduce disposable income for people already dealing with the recently implemented housing charge and greater National Social Security Fund deductions.

To compensate for the loss of personal relief, the National Treasury intends to implement a new PAYE tax band of zero percent, which would benefit low-income taxpayers. Simultaneously, the government is considering lowering the top PAYE tax rate for wealthy incomes from 35% to 25% as part of a larger attempt to remove tax avoidance and evasion options.

This development followed the creation of new tax bands of 32.5 percent and 35 percent in the 2023 Finance Act for monthly employment income above Sh500,000 and Sh800,000, respectively. However, experts doubt that these reforms will result in much higher revenue for the government, given that the majority of Kenyans earn less than Sh100,000 each month.

Workers earning up to Sh24,000 per month are currently exempt from PAYE taxes due to the Sh2,400 personal relief, which matches the 10% tax rate on the lowest tax band. The remaining salaried workers are subject to PAYE taxes at rates of 25% and 30%, respectively.

![Kenya’s Top 10 Marketable Degree Programs [List] Kenya's Top 10 Marketable Degree Programs [List]](https://opportunitiesforkenyans.co.ke/wp-content/uploads/2025/02/Kenyas-Top-10-Marketable-Degree-Programs-List-100x70.jpg)